jersey city property tax rate 2020

The average effective property tax rate in New Jersey is 240 which is. Homeowners in New Jersey pay the highest property taxes of any state in the country.

New Jersey Property Taxes Go To Different State 657900 Avg.

. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON. New Jerseys real property tax is an ad valorem tax or a tax according to value. Select the Icons below to view the assessments in Adobe Acrobat or Microsoft Excel.

Overview of New Jersey Taxes. July 11 2022 Click here for a map with more tax information The General. Property taxes are calculated based on the total assessed value of the property land value improvements value - exemptions divided by 100 and multiplied by the tax rate.

Jersey city property tax rate 2020. In New Jersey property taxes are calculated using the formula. City Hall 280 Grove Street.

Average Effective Property Tax Rate 2020 Atlantic County. All real property is assessed according to the same standard. The minimum combined 2022 sales tax rate for Jersey City New Jersey is.

In fact rates in some areas are more than double the national average. Property Tax Rate per 100 2019-2020 2020-2021 Difference Debt Service 0136379 0132072 -004307 Operations. 2020-2022 Agendas Minutes and Ordinances.

Jersey city property tax rate 2020 Read More. The average effective property tax rate in New Jersey is 242 compared with a national average of 107. 189 of home value Tax amount varies by county The median property tax in New Jersey is 657900 per year for a.

Jersey City Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps you arent informed about your property bill. General Property Tax Information. Online Inquiry Payment.

City of Jersey City. Assessed Value x General Tax Rate100 There is a property tax levied on property owners. Ad View County Assessor Records.

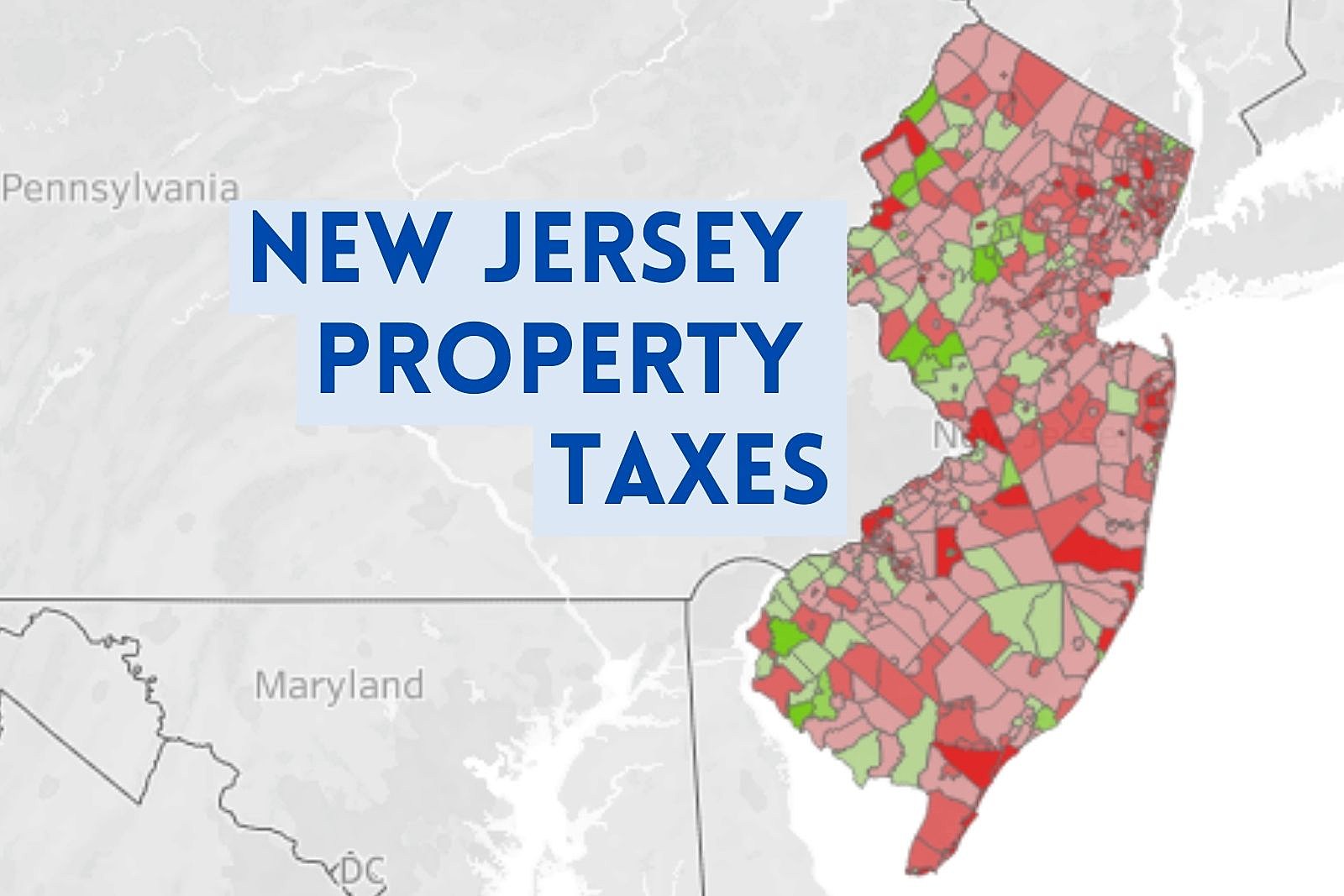

2021 New Jersey Property Tax Rates Average Tax Bills and Assessed Home Values Last updated.

Division Of Police City Of Jersey City

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent

How To Stay Sane When Buying A Home In Nj Better Mortgage

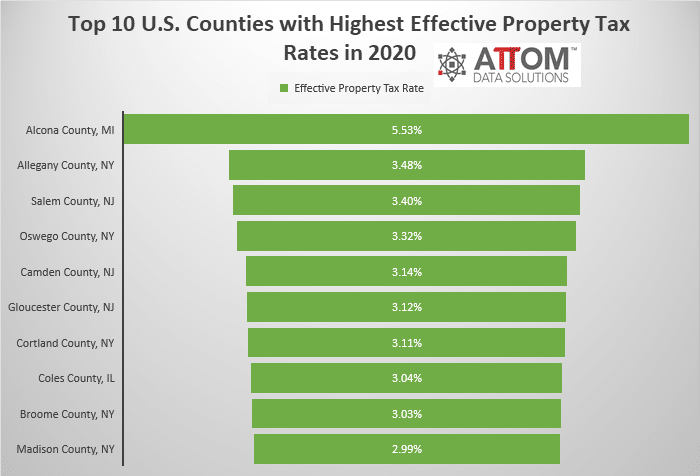

Top 10 U S Counties With Highest Effective Property Tax Rates Attom

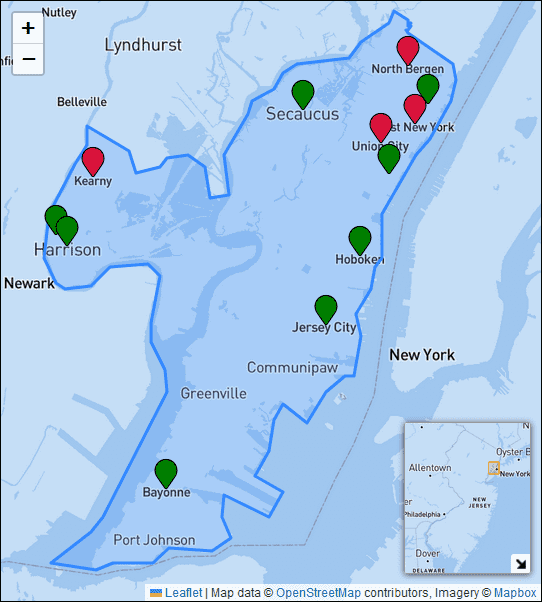

Property Tax Rates Average Tax Bills And Average Home Valuations In Hudson County New Jersey

Property Tax Calculator Smartasset

Average Nj Property Tax Bill Near 9 300 Check Your Town Here

Property Revaluation 701 Property Tax Appeal Math Are You Over Assessed A Tax Math Explainer Civic Parent

New York Property Tax Calculator 2020 Empire Center For Public Policy

Here S The Average Property Tax Bill In Princeton Princeton Nj Patch

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

How Much It Costs To Live In New Jersey Versus New York City

Nj Division Of Taxation Sales And Use Tax

Average Nj Property Tax Bill Near 9 300 Check Your Town Here

Interactive Map The High Low And In Between Of Nj S Property Taxes Nj Spotlight News

Where Do People Pay The Most In Property Taxes

How Do State And Local Property Taxes Work Tax Policy Center

U S Property Taxes Comparing Residential And Commercial Rates Across States

Jersey City Budgets The Connection To Property Tax Expense An Interactive Teaching Visual Civic Parent