stock market bubble meaning

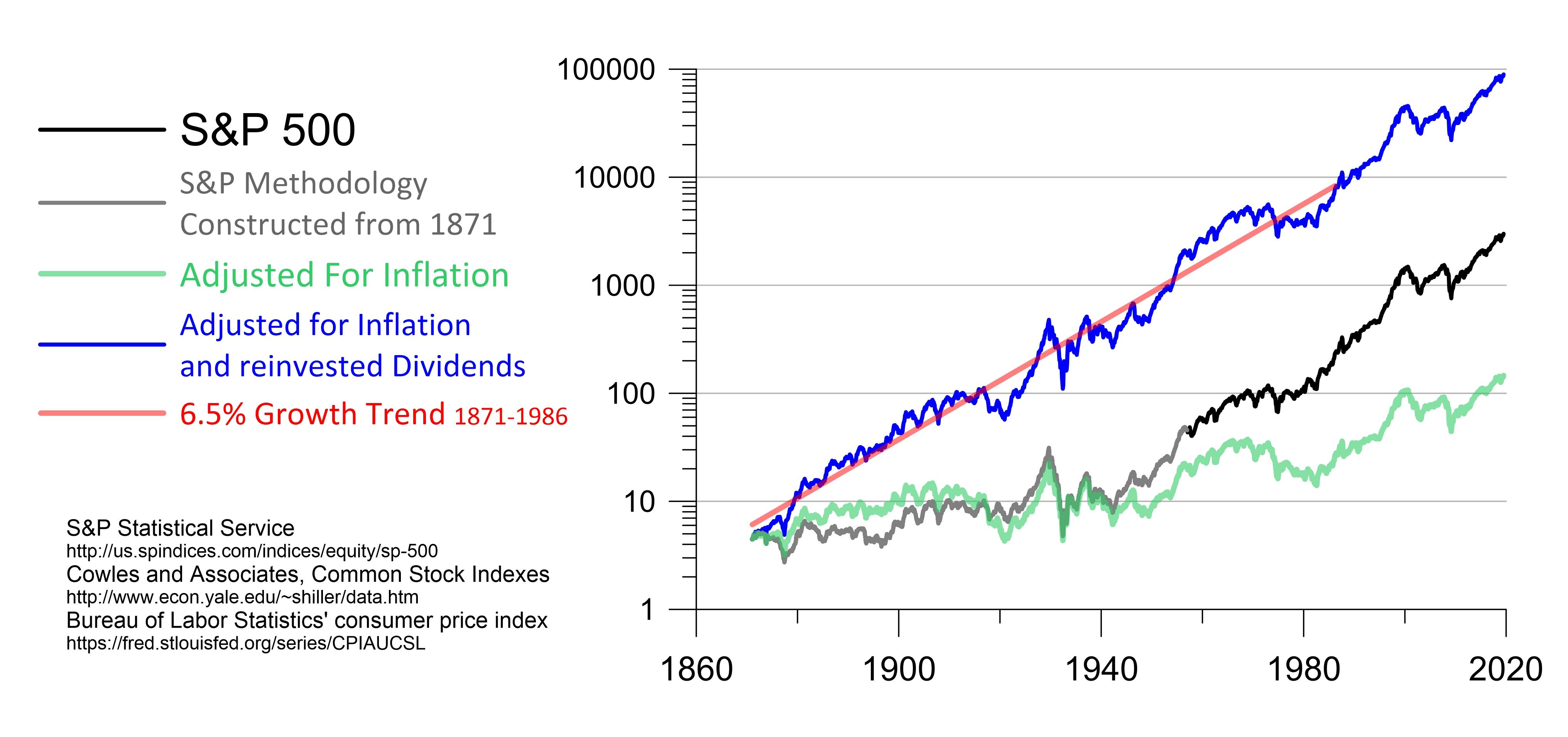

A stock market bubble is a period of growth in stock prices followed by a fall. If you put your money in the market you want to get back more than you put in.

Stock Market Bubbles Definition And Examples Smartasset

STOCK MARKET BUBBLE meaning - STOCK MARKET BUBBLE definition - STOCK MARKET BUBBLE explanati.

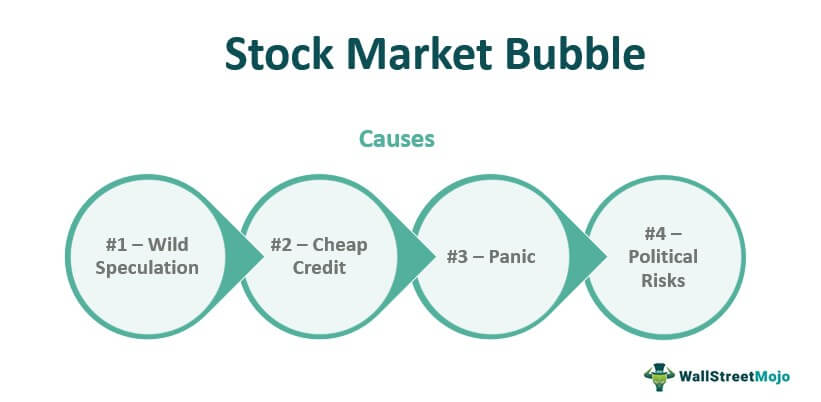

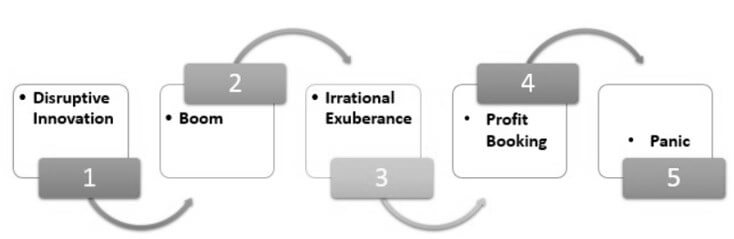

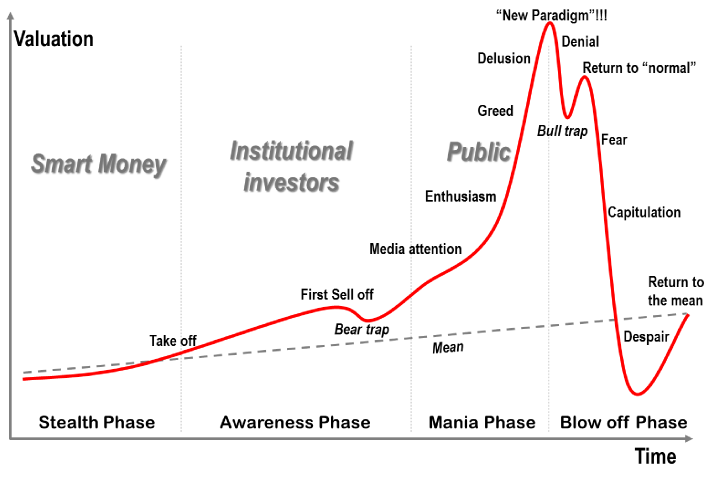

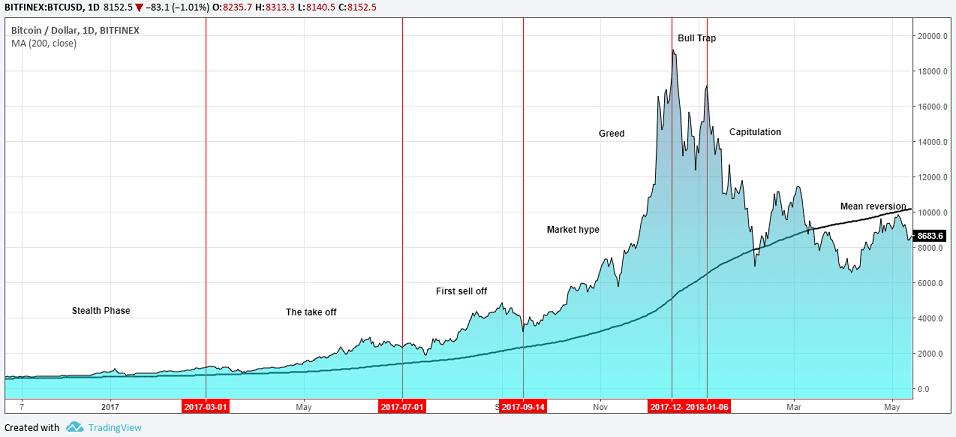

. A bubble is a sudden rise in the prices of stocks belonging to a particular sector buoyed by investor belief in the future performance potential that makes them attain values which are far beyond their intrinsic price. Understand the life cycle of a stock market bubble. What a real estate bubble would mean for homebuyers.

Double-click on a bubble to display detailed information in a new window. Most stock quote data provided by BATS. Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior.

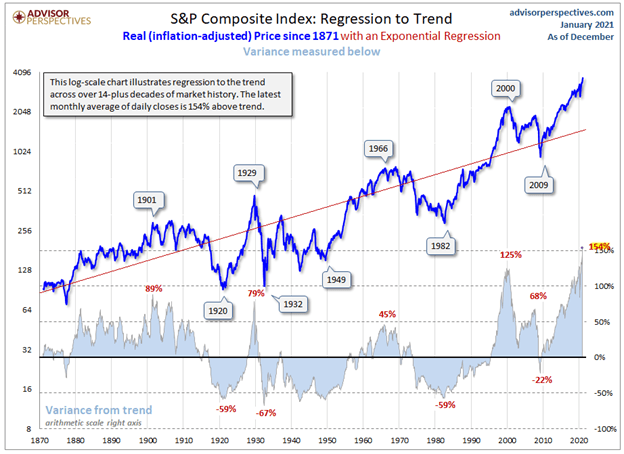

Other theoretical explanations of stock market bubbles have suggested that they are rational intrinsic and contagious. The term is commonly used when talking about the property market housing bubble. Economists define a bubble as an economic cycle characterized by rapid expansion followed by a contraction.

A stock market bubble is a period of growth in stock prices followed by a fall. What does STOCK MARKET BUBBLE mean. In my trades I aim to get back three times as much money as I can accept losing.

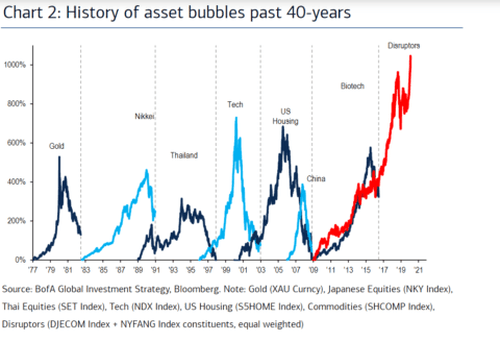

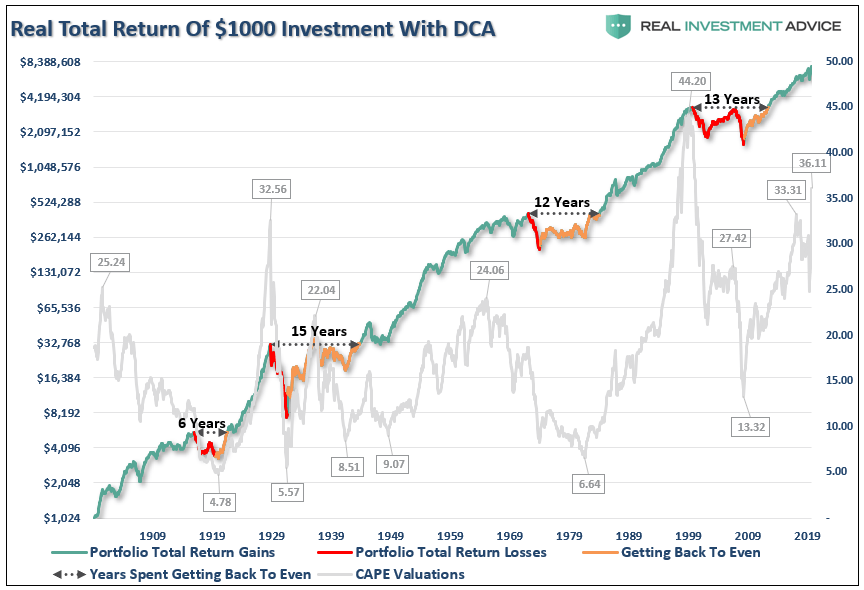

An economic bubble also known as a market bubble or price bubble occurs when securities are traded at prices considerably higher than their intrinsic value followed by a burst or crash when prices tumble. He noted that US stocks have experienced two such superbubbles before. Because there is disagreement between market participants as to that value bubbles can be hard to detect as they are taking place.

What is a stock market bubble. Typically prices rise quickly and significantly growing. In a bubble no one wants.

Once a bubble bursts a stock market crash often follows. It starts with a new idea that has a potential for big profits. Investors start buying into these companies and the stock price goes up.

A stock market bubble happens when a stock costs a lot more than its worth or the market in general is overvalued. Stock market bubble is a term thats used when the market appears exceptionally overvalued driven by a combination of heightened enthusiasm unrealistic expectations and reckless speculation. Market indices are.

The equity bubble has now been joined by a bubble in housing and an incipient bubble in commodities 3. The term bubble in an economic context generally refers to a situation where the price for somethingan individual stock a financial asset or even an entire sector market or asset class. This is a very expensive market but its likely not a bubble.

A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation. When the price of stocks surge and demand reaches a fever pitch investors may wonder. A stock market bubble refers to a surge in share prices to levels significantly above their fundamental value.

In simpler terms its an overheated market whether it be stocks bonds real estate commodities technology etc where too many investors become overly eager to buy. What is a Stock Market Bubble. A stock market bubble is a significant run-up in stock prices without a corresponding increase in the value of the businesses they represent.

STOCK MARKET BUBBLE meaning - STOCK MARKET BUBBLE de. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How. Bubbles occur not only in real-world markets with their inherent.

Are we in a stock market bubble. When they fall they do so quickly and often below the starting value. The dot-com bubble and housing market.

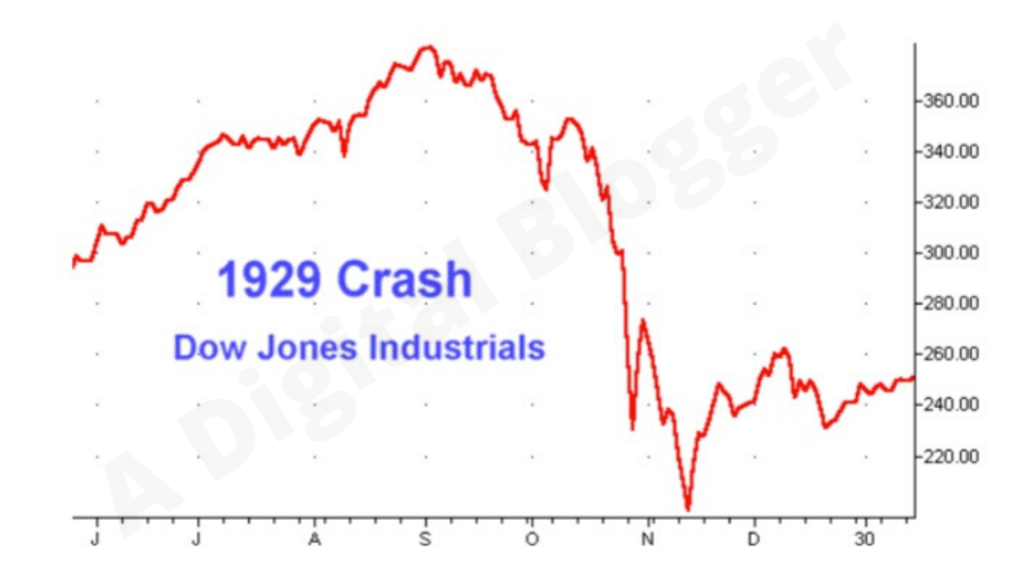

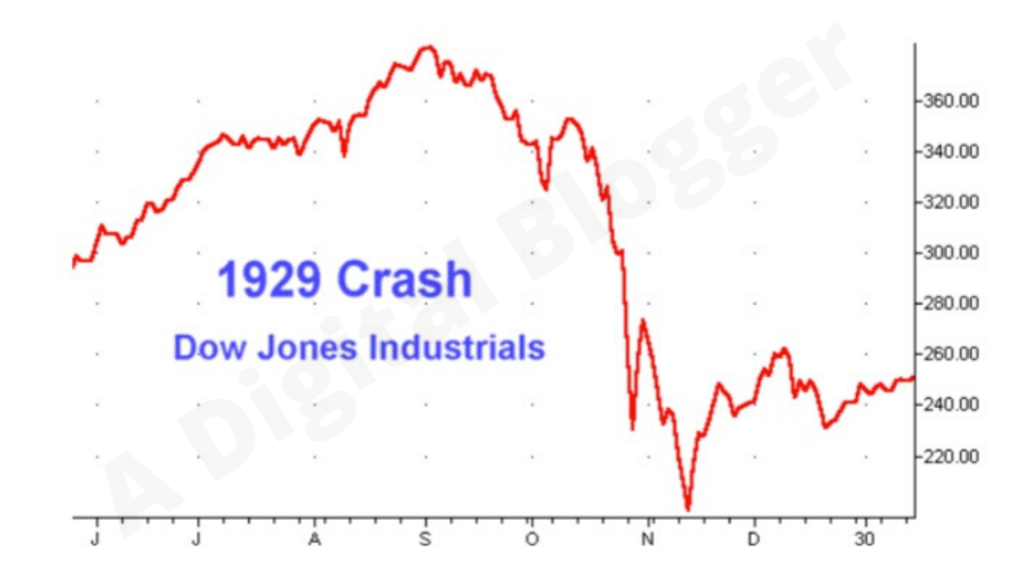

Jeremy Grantham the British co-founder of Boston-based investment manager GMO believes the US is now in a super-bubble comparable to the dotcom era the Wall Street crash of 1929 and the. 1929 a market fall that led to the Great Depression and again in. A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation.

Followed by a gradual or sudden decline burst in their prices as investors offload their holding in them. Participation of investors in the market as a sign that a bubble is brewing. That doesnt mean it cant go down of course potentially by a lot.

Typically prices rise quickly and significantly growing far beyond their previous value in a short period of time. While in many respects the stock market looks like a bubble the underlying foundation is different. What Is a Stock Market Bubble.

Stock Markets Protect Your Wealth From Market Bubbles The Financial Express

Stock Market Bubble Definition Example How To Check

Is The Fed Fueling A Giant Stock Market Bubble

:max_bytes(150000):strip_icc()/dotdash_INV_final_Irrational_Exuberance_Jan_2021-01-45e4d7c38e1f47f290063b49bf234f9a.jpg)

Irrational Exuberance Definition

We Are Now Officially In A Stock Market Bubble Seeking Alpha

What Is A Stock Market Bubble The Motley Fool

Yes Virginia There Is A Stock Market Bubble Seeking Alpha

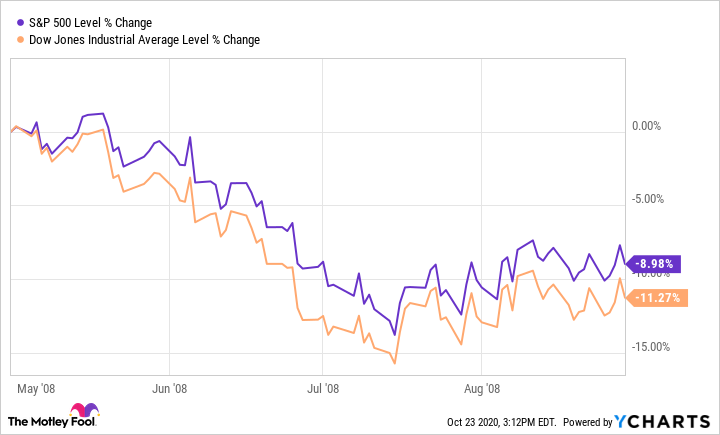

What Are Stock Market Corrections The Motley Fool

Biggest Stock Market Crashes In History The Motley Fool

The Fed S Stock Market Bubble Is At Risk As China Bursts Its Real Estate Bubble Chemicals And The Economy

Stock Market Bubble Definition Example How To Check

What Is A Stock Market Bubble Forbes Advisor

Yes Virginia There Is A Stock Market Bubble Seeking Alpha

We Are Now Officially In A Stock Market Bubble Seeking Alpha

Stock Market Crash 1929 Definition Facts Timeline Causes Effects

Investors Can T Ignore This Clear Sign Of A Stock Market Bubble Seeking Alpha

Stock Market Super Bubble And The Demographic Trigger Seeking Alpha

See How To Identify And Trade Stock Market Bubbles Tradingsim

:max_bytes(150000):strip_icc()/dotdash_INV-final-Stock-Market-Crash-July-2021-01-88a96c7bec2846dd9986a5777c089417.jpg)